Blog

Estate Planning for Families in West Michigan: What Every Parent Needs to Know

When families think about the future, they often focus on savings, education, and retirement. However, estate planning for families in West Michigan protects everything you build. Without a proper plan, Michigan law, not your wishes, determines who manages your children’s care, finances, and inheritance. As…

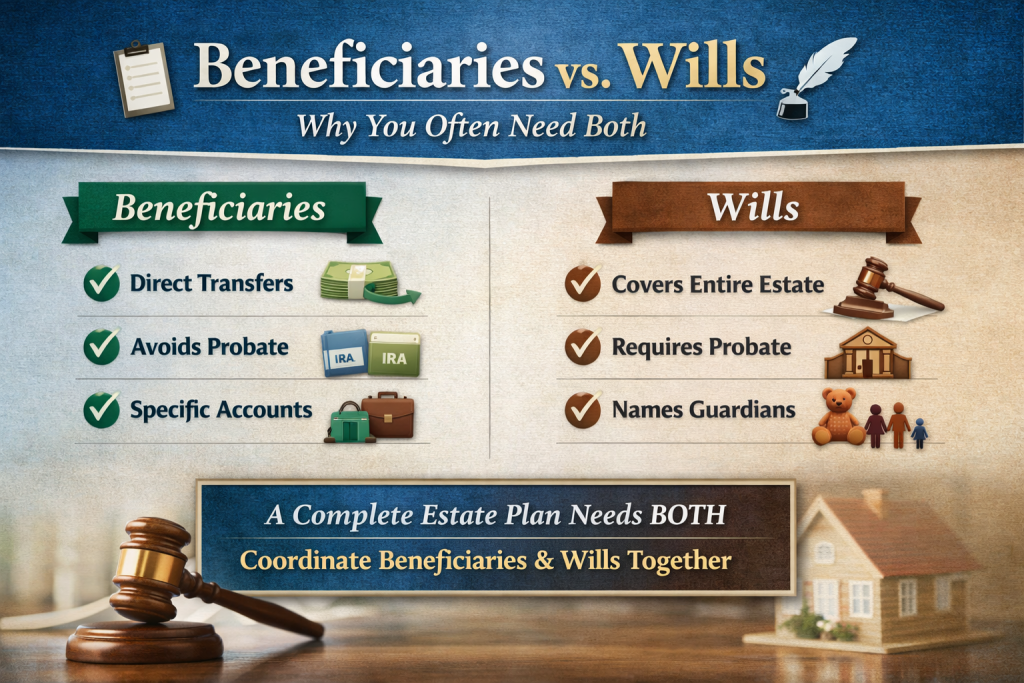

Beneficiaries vs. Wills: Why You Often Need Both

Many people assume that beneficiary designations replace the need for a will. However, this misunderstanding causes serious problems for families every year. When comparing beneficiaries vs. wills, the truth is simple: most people need both for a complete estate plan. Beneficiaries control some assets, however,…

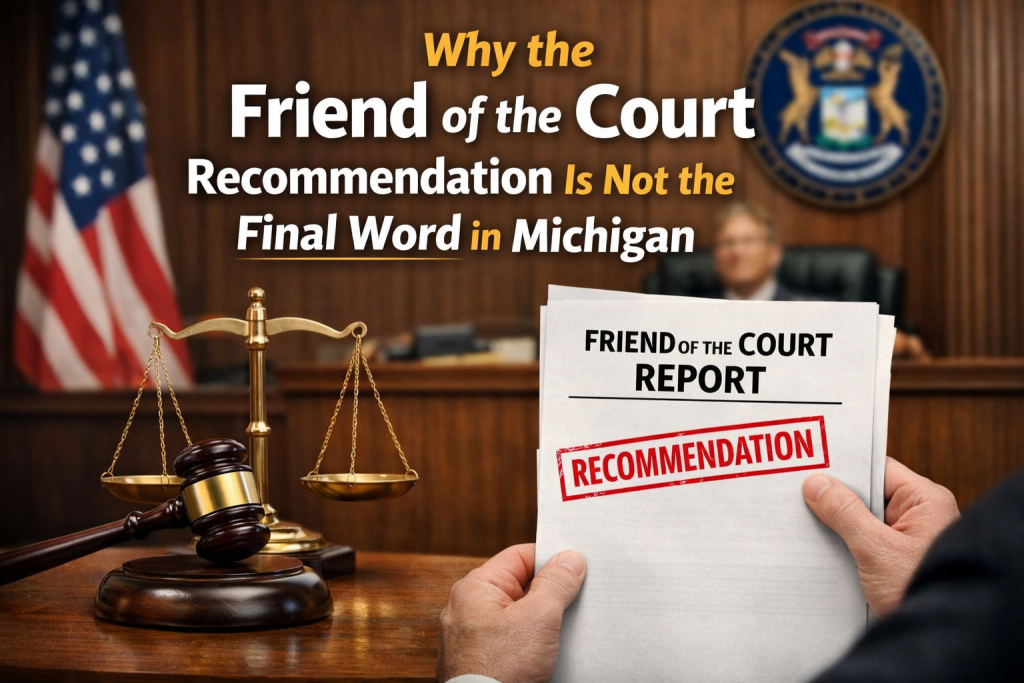

Why the Friend of the Court Recommendation Is Not the Final Word in Michigan

Receiving a Friend of the Court recommendation in Michigan often feels overwhelming. Many parents assume the recommendation decides their custody or parenting time outcome. However, that assumption creates unnecessary fear and costly mistakes. In reality, a Friend of the Court recommendation does not automatically decide…

10 Michigan Probate Questions Families Google Most

When a loved one passes away, families often turn to Google before calling a lawyer. They want quick, clear answers during an emotional and confusing time. These Michigan probate questions appear repeatedly because probate affects real families dealing with deadlines, paperwork, and uncertainty. Understanding the…